Use these links to rapidly review the document

TABLE OF CONTENTS

CD&A Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )1)

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

Preliminary Proxy Statement | ||

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

Definitive Proxy Statement | ||

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| Virtusa Corporation | ||||

| | | | |

| (Name of Registrant as Specified In Its Charter) | ||||

| | | | |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

(1) | Title of each class of securities to which transaction applies: | |||

(2) | Aggregate number of securities to which transaction applies: | |||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

(4) | Proposed maximum aggregate value of transaction: | |||

(5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

(2) | Form, Schedule or Registration Statement No.: | |||

(3) | Filing Party: | |||

(4) | Date Filed: | |||

Preliminary Proxy Statement—Subject to Completion Dated, August 10, 2020

![]()

July 27, 2018

[ · ] 2020

Dear Stockholder:Virtusa Stockholders and Stakeholders:

YouIt is likely that what we do touches your lives daily, even if you do not see our name on products or services you buy as individuals. Virtusa is a leading global information technology (IT) services firm providing deep industry based digital engineering and consulting. We design and build end-to-end digital systems and applications that help businesses move faster, operate more efficiently, and serve their customers in ways that are cordially invitedoptimized for today's digital economy. Our digital engineering services and solutions meet some of the most complex and rapidly evolving technology needs of Global 2000 customers worldwide.

The emergence of the COVID-19 pandemic in early 2020 has created unprecedented challenges for economies and communities around the world. It has also created challenges for Virtusa and the IT services industry as a whole. From this crisis, however, we have learned just how important Virtusa is to attendour clients, and how dedicated our global team is to serving our clients to ensure their success even under the annual meetingmost extraordinary circumstances. Since the onset of COVID-19, we have upheld our commitment to our clients by maintaining nearly uninterrupted service and developing new solutions that help them address the economic challenges of the pandemic. We have also doubled down on our commitment to our stockholders by intensifying our efforts under our Three-Pillar strategy to increase our profitable revenue growth, achieve greater revenue diversification, and improve our long-term gross and operating margins. Finally, and most importantly, we have kept our commitment to our employees and our community by doing everything in our power to ensure the health and well-being of Virtusa Corporationour global team members and their families. Today, nearly all of our global delivery team has the ability to be held at 8:00 a.m., local time, on Thursday, September 6, 2018 at the offices of Virtusa Corporation located at 132 Turnpike Road, Southborough, Massachusetts 01772.work from home and we have put strict measures in place to help ensure our people remain safe and healthy.

At this annual meeting, youLooking ahead to the remainder of our fiscal 2021 and beyond, we remain steadfast in our commitment to our clients, our stockholders, our team, and our community. We will be askedcontinue to (i) elect three (3) class IIhelp our clients in their time of need by delivering leading services and solutions that help them navigate the challenges of COVID-19 and emerge stronger competitors in their respective industries. To do so, we will focus on strengthening our skills and capabilities that enable our clients' digital transformation and empower our clients to flourish in the digital economy. We have already launched several new initiatives on both the client development and cost containment sides of our business to ensure we continue to make progress against our long-term plan and deliver increased value to our stockholders. In addition, we recently increased the strength of our already exceptional board of directors as nominated bywith the election of former Wipro Chief Executive Officer, Abidali Neemuchwala, to our board of directors,directors. Finally, we will focus on finding and keeping the best people throughout our organization. Our performance management systems are individual, real time, continual, and visible to all employees. We monitor and disclose turnover data and apply our own digital expertise to encourage employee feedback, engagement, training, retention and well-being.

Our focus on sustainable operations helps reduce our risks and enhance our financial sustainability. Our key sustainability disclosures are third-party certified by International Organization for Standardization ("ISO") and Occupational Health and Safety Assessment Series ("OHSAS") and result in excellent grades from leading scorers including top marks from Institutional Shareholder Services Inc. ("ISS") for environmental and social, an A from MSCI and a three-year term, and, with respect to the holders of our Series A Convertible Preferred Stock, one (1) Series A director, until his/her successor is duly elected and qualified or until such Series A director's right to hold the office terminates, whichever occurs earlier, (ii) ratify the appointment of our independent registered public accountants, (iii) cast an advisory vote on the compensation of our named executive officers, and (iv) transact such other business as may properly come before the annual meeting and any adjournments or postponements thereof. The board of directors unanimously recommends that you vote FOR electionB from CDP.

On behalf of the director nominees, FOR ratification of appointment ofboard and management, we extend our independent registered public accountantsappreciation for your support and FOR approval, on an advisory basis, of the compensation of our named executive officers.

Details regarding the matters to be acted upon at this annual meeting appearinterest in the accompanying proxy statement. Please give this material your careful attention.

Whether or not you plan to attend the annual meeting, please submit your vote via the Internet (www.envisionreports.com/VRTU), by telephone (1-800-652-VOTE (8683)), or by your proxy by completing, signing and dating the enclosed proxy card and returning it in the envelope provided as soon as possible so that your shares will be represented at the annual meeting. If you vote via the Internet or by telephone or send your proxy in, you will not limit your right to vote in person at the annual meeting. Your prompt cooperation will be greatly appreciated.Virtusa.

| Very truly yours, | ||

Kris Canekeratne |

| 1 | |||

2020 Annual Stockholders Meeting | 1 | |||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| 87 | |||

Appendix A: Reconciliation of GAAP and Non-GAAP Financial Measures | ||||

Appendix B: Information Concerning Persons Who Are Deemed Participants in Virtusa Corporation's Solicitation of Proxies | 93 |

Virtusa Corporation132 Turnpike RoadSouthborough, Massachusetts 01772(508) 389-7300![]()

NOTICE OF ANNUAL MEETING OF STOCKHOLDERSTo Be Held on Thursday, September 6, 2018

To the Stockholders of Virtusa Corporation:

TheYou are cordially invited to attend the annual meeting of stockholders of Virtusa Corporation, a Delaware corporation (the "Company"), at:

DATE

[ · ] [ · ]

2020

TIME

[ · ]

(Eastern Standard Time)

The annual meeting will be held on Thursday, September 6, 2018,virtually via https://www.cesonlineservices.com/vrtu20_vm, and will begin promptly at 8:00 a.m., local time, at Virtusa Corporation located at 132 Turnpike Road, Southborough, Massachusetts 01772,[ · ]. If you plan to participate in the virtual meeting, you will need to pre-register by [ · ]. To pre-register for the following purposes:meeting, please follow the instructions provided under "General Information" in the proxy statement accompanying this notice. Stockholders will be able to listen, vote, and submit questions from their home or from any remote location that has Internet connectivity. There will be no physical location for stockholders to attend. Stockholders may only participate online and must pre-register.

ITEMS OF BUSINESS:

At the annual meeting, you will be asked:

Proposal 1 relates solely to the election of three (3)two (2) class III directors and the one (1) Series A director nominated by the board of directors and does not include any other matters relating to the election of directors, including without limitation, the election of directors nominated by any stockholder of the Company. New Mountain Vantage Advisers, L.L.C. ("NMV") has notified the Company that NMV intends to nominate three individuals for election as directors at the annual meeting in opposition to the nominees recommended by our board of directors. Any candidates nominated by NMV have NOT been endorsed by our board of directors. OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU DO NOT SIGN ANY PROXY CARDS SENT TO YOU BY NMV. IF YOU HAVE PREVIOUSLY SIGNED A PROXY CARD SENT TO YOU BY NMV, YOU CAN REVOKE IT BY SIGNING, DATING AND MAILING THE ENCLOSED WHITE PROXY CARD IN THE ENVELOPE PROVIDED, OR, IF YOUR SHARES ARE HELD IN STREET NAME, BY INSTRUCTING YOUR BROKER TO VOTE YOUR SHARES FOR THE WHITE PROXY CARD.

RECORD DATE:

Only stockholders of record at the close of business on July 17, 2018,[ · ], are entitled to notice of and to vote at the annual meeting and at any adjournment or postponement thereof.

HOW TO VOTE:

All stockholders are cordially invited to attend the annual meeting in person.virtually. However, to assure your representation at the annual meeting, we urge you, whether or not you plan to attend the annual meeting, to submit your vote via the Internet, (www.envisionreports.com/VRTU),or by telephone, (1-800-652-VOTE (8683)),following the instructions on the WHITE proxy card, or by completing, signing and dating the enclosedWHITE proxy card and returning it in the envelope provided as soon as possible so that your shares will be represented at the annual meeting. If you vote via the Internet or by telephone or send your proxy in, you will not limit your right to vote in personvirtually at the annual meeting. If you have any questions about the annual meeting or how to vote your shares, please contact MacKenzie Partners, Inc., our proxy solicitor assisting us in connection with the annual meeting. Stockholders may call toll free at 1-800-322-2885 or collect at 212-929-5500.

| By | ||

| ||

Ranjan Kalia Executive Vice President, Chief Financial Officer, | ||

[·], 2020 | Treasurer and Secretary |

Southborough, MassachusettsJuly 27, 2018

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON THURSDAY, SEPTEMBER 6, 2018: THE PROXY

STATEMENT AND ANNUAL REPORT TO SHAREHOLDERS ARE AVAILABLE AT www.envisionreports.com/VRTU, FOR REGISTERED HOLDERS AND AT www.edocumentview.com/VRTU FOR BENEFICIAL/STREET HOLDERS.

WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING IN PERSON, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY CARD AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE, OR PLEASE PROMPTLY SUBMIT YOUR VOTE VIA THE INTERNET (www.envisionreports.com/VRTU), OR BY TELEPHONE (1-800-652-VOTE (8683)), IN ORDER TO ASSURE REPRESENTATION OF YOUR SHARES. NO POSTAGE NEED BE AFFIXED IF THE PROXY CARD IS MAILED IN THE UNITED STATES.

IN ACCORDANCE WITH OUR SECURITY PROCEDURES, ALL PERSONS ATTENDING THE ANNUAL MEETING WILL BE REQUIRED TO PRESENT PICTURE IDENTIFICATION.

VIRTUSA CORPORATION

PROXY STATEMENT132 Turnpike RoadSouthborough, Massachusetts 01772For the Annual Meeting of Stockholders

To be Held on [ · ], 2020

2020 Annual Stockholders Meeting

PROXY STATEMENTFOR THE ANNUAL MEETING OF STOCKHOLDERSTo Be Held on Thursday, September 6, 2018

July 27, 2018

This proxy statement isand the accompanying WHITE proxy card are furnished in connection with the solicitation of proxies by the board of directors of Virtusa Corporation, a Delaware corporation (the "Company," "our," "we" or "us"), for use at the annual meeting of stockholders to be held on Thursday, September 6, 2018,[ · ], at 8:00 a.m.[ · ]., local time, or at the offices of Virtusa Corporation located at 132 Turnpike Road, Southborough, Massachusetts 01772, and any adjournments or postponements thereof. An annual report to stockholders, containing financial statements for the fiscal year ended March 31, 2018,2020, is being mailed together with this proxy statement to all stockholders entitled to vote at the annual meeting. This proxy statement and the form ofaccompanying WHITE proxy card are expected to be first mailed to stockholders on or about August 2, 2018.[ · ].

The purposes of the annual meeting are to (i) elect three (3)two (2) class III directors, as nominated by our board of directors, for a three-year term, and, with respect to the holders of our Series A Convertible Preferred Stock, one (1) Series A director, as nominated by our board of directors, until his/her successor is duly elected and qualified or until such Series A director's right to hold the office terminates, whichever occurs earlier, (ii) ratify the appointment of the accounting firm of KPMG LLP as the Company's independent registered public accountants for the current fiscal year, and (iii) holdto approve, on an advisory vote onbasis, the compensation of our named executive officers, and (iv) transact such other business as may properly come before the annual meeting and any adjournments or postponements thereof.NEOs. The board of directors unanimously recommends that you vote FOR election of the director nominees, FOR ratification of the appointment of our independent registered public accountants and FOR approval, on an advisory basis, of the compensation of our named executive officers.NEOs.

Only stockholders of record at the close of business on July 17, 2018,[ · ], the record date, will be entitled to receive notice of and to vote at the annual meeting. As of July 17, 2018, 32,741,394the record date, [ · ] shares of common stock, $.01 par value per share, of the Company were eligible to vote at the annual meeting, of which 29,741,394[ · ] shares of common stock were issued and outstanding and 3,000,000 shares of common stock were issuable upon conversion of the 108,000 shares of Series A Convertible Preferred Stock, $.01 par value per share (the "Series A Preferred Stock") which are issued and outstanding. The holders of common stock (including the 3,000,000 shares of common stock issuable upon conversion of the Series A Preferred Stock) are entitled to one vote per share on any proposal presented at the annual meeting.

The annual meeting will be held virtually via https://www.cesonlineservices.com/vrtu20_vm, and will begin promptly at [ · ]. Stockholders will be able to listen, vote, and submit questions from their home or from any remote location that has Internet connectivity. There will be no physical location for stockholders to attend. Stockholders may voteonly participate online and must pre-register. In order to attend the virtual-only meeting, you will need to pre-register by [ ]. To pre-register for the meeting, please follow these instructions:

If your shares are registered in personyour name with our transfer agent and you wish to attend the virtual meeting, please go to https://www.CESVote.com, enter the control number you received on

your WHITE proxy card to access the voting page, then click on the "Click here to pre-register for the online meeting" link at the top of the page.

If you do not have your WHITE proxy card, you may pre-register to attend the virtual meeting by emailing your proof of ownership of shares of our common stock as of [ ] to VRTURegister@Proxy-Agent.com. Your proof of ownership may include a copy of your proxy card received either from us or from NMV or a statement showing your ownership of shares of our common stock as of [ ]. After pre-registering, and upon verification of your ownership, you will receive a confirmation email prior to the annual meeting with instructions for attending the virtual annual meeting online.

If your shares are not registered in your name with our transfer agent, but you are a beneficial owner and your shares are held by a broker, bank, financial institution or other nominee or intermediary in "street name" as of [ ], you may pre-register to attend the annual meeting by emailing VRTURegister@Proxy-Agent.com and attaching evidence that you beneficially owned shares of our common stock as of [ ], which evidence may consist of a copy of the Voting Instruction Form (or Notice) provided by your broker, bank, financial institution or other nominee or intermediary, an account statement, or a letter or legal proxy or stockholdersfrom such custodian. After pre-registering, and upon verification of your ownership, you will receive a confirmation email prior to the annual meeting with instructions for attending the virtual annual meeting online.

Stockholders may submit their vote via the Internet, (www.envisionreports.com/VRTU), by telephone (1-800-652-VOTE (8683))(following the instructions on the WHITE proxy card), or by completing, signing and dating the enclosedWHITE proxy card and returning it in the envelope provided as soon as possible so that the stockholderstockholder's shares will be represented at the annual meeting. If you attend the annual meeting, you may vote in personvirtually even if you have previously returned yourWHITE proxy card or voted via telephone or the Internet. Voting via the Internet or telephone will not limit your right to vote in personvirtually at the annual meeting as stated above. Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted. Proxies may be revoked by (i) filing with the Secretary of the Company, before the taking of the vote at the annual meeting, a written notice of revocation bearing a later date than the proxy, (ii) duly completing a later-dated proxy relating to the

same shares and delivering it to the Secretary of the Company before the taking of the vote at the annual meeting, or (iii) attending the annual meeting and voting in personvirtually (although attendance at the annual meeting will not in and of itself constitute a revocation of a proxy). Any written notice of revocation or subsequent proxy should be sent before the taking of the vote at the annual meeting so as to be delivered to:to Virtusa Corporation, 132 Turnpike Road, Southborough, Massachusetts 01772, Attention: Secretary, before the taking of the vote at the annual meeting.Secretary.

The representation in personvirtually or by proxy of at least a majority of the outstanding shares of commonthe capital stock of the Company issued and outstanding and entitled to vote at the annual meeting is necessary to constitute a quorum for the transaction of business. Votes withheld from any nominee, abstentions and broker "non-votes" are counted as present or represented for purposes of determining the presence or absence of a quorum for the annual meeting. A "non-vote" occurs when a nominee holding shares for a beneficial owner votes on one proposal but does not vote on another proposal because, with respect to such other proposal, the nominee does not have discretionary voting power and has not received instructions from the beneficial owner. It is anticipated that the 2020 Annual Meeting of Stockholders will be contested (see the foregoing discussion) as such broker "non-votes" may not occur.

For Proposal 1, the three (3) class IIour by-laws require that each director nomineesnominee shall be elected if the number of votes cast for such nominee's election exceed the number of votes cast against such nominee's election, except where a different vote is required by law, the certificate of incorporation (including

any certificates of the powers, designations, preferences and rights of any class or series of stock) or the one (1)by-laws; provided, however, that in a contested election, a nominee shall be elected by a plurality of the votes cast, meaning that the director nominees receiving the most votes would be elected. The certificates of the powers, designations, preferences and rights of the Series A director isConvertible Preferred Stock require that the Series A Director shall be elected by the affirmative vote of a majority of the votes properly cast by the holders of the Series A Convertible Preferred Stock for such election at the annual meeting.

New Mountain Vantage Advisers, L.L.C. ("NMV") has notified us of its intent to nominate three individuals for election as directors at the annual meeting. If NMV proceeds with its alternative nominations, the election of directors would be considered a contested election. As a result, the two (2) director nominees for the Class I directors receiving the most votes at the annual meeting will be elected and the one (1) Series A director shall be elected by a majority of the votes properly cast by the holders of Series A Convertible Preferred Stock for such election at the annual meeting. You may not vote your shares cumulatively or for a greater number of persons than the number of director nominees named in this proxy statement. In the event NMV does not proceed with its nominations or withdraws its nominees on or prior to the day preceding the date the Company first mails the proxy materials for the annual meeting to the Company's stockholders, the election of directors will not be contested, and the director nominees for Class I directors will be elected if the number of votes cast for such nominee's election exceed the number of votes cast against such nominee's election.

For Proposal 2, the ratification of the appointment of KPMG LLP as the Company's independent registered public accountants for the current fiscal year, and for Proposal 3, the advisory vote on theapproval of compensation of our named executive officers,NEOs, an affirmative vote of a majority of the shares properly cast for and against each such matter is required for approval.

Brokerage firms, banks and other nominees who hold shares on behalf of their clients in "street name" are not permitted to vote the shares if the clients do not provide instructions (either vote FOR, or vote AGAINST, WITHHOLD their vote, or ABSTAIN) on matters that are not routine matters. If NMV provides proxy materials in opposition to our board of directors to your broker to forward to you on its behalf, your broker will not have discretionary authority to vote your shares are heldon any of the matters to be presented at the annual meeting. Therefore, if you hold your shares in "street-name" through a broker thoseor other nominee, absent voting instructions from you, your shares will not be votedcounted as voting and will have no effect on those proposals requiring approval by a plurality or majority of the votes cast. On the other hand, in the absence of NMV providing proxy materials in opposition to our board to your broker to forward to you on its behalf, Proposal 1 (the election of directors) or Proposal 3 (the advisory vote on2 to ratify the compensationappointment of our named executive officers), unless you affirmatively provide theindependent registered public accountants will be a "routine" matter for which your broker instructions on howdoes not need your voting instruction in order to vote.vote your shares. Abstentions and broker "non-votes" will have no effect in determining the outcome of Proposal 1. Abstentions and broker "non-votes" are not counted as votes cast for or against a matter and thus will have no effect on Proposals 2 and 3.

The persons named as attorney-in-fact in the proxies, Ranjan Kalia, Executive Vice President, Chief Financial Officer, Treasurer and Secretary of the Company, and Paul D. Tutun, Executive Vice President, General Counsel and Assistant Secretary, were selected by the board of directors. All properly executedWHITE proxies returned in time to be counted at the annual meeting including any votes properly made via the Internet or telephone, will be voted by such personsthe named proxies at the annual meeting. Where a choice has been specified on the WHITEproxy with respect to the foregoing matters, the shares represented by the WHITEproxy will be voted in accordance with the specifications. If noyou return a validly executed WHITE proxy card without indicating how your shares should be voted on a matter and you do not revoke your proxy, such specifications are indicated, suchWHITE proxies will be voted FOR election of the director nominees set forth on the WHITE proxy card, FOR ratification of the appointment of our independent registered public accountants for the current fiscal year, and FOR the approval, on an advisory basis, of the compensation of our named executive officers

NEOs. OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU DO NOT SIGN OR OTHERWISE VOTE USING ANY PROXY CARD SENT TO YOU BY NMV.

If you have any questions or require assistance with voting, please call:

Toll-Free at 800-322-2885

Call Collect at 212-929-5500

Email: VRTU@mackenzieparnters.com

Aside from the election of directors, the ratification of the appointment of the independent registered public accountants and the advisory vote on the compensation of our named executive officers,NEOs, the board of directors knows of no other matters to be presented at the annual meeting. If any other matter should be presented at the annual meeting upon which a vote properly may be taken, shares represented by all proxies received by the board of directors will be voted with respect thereto in accordance with the judgment of the persons named as attorney-in-fact in the proxies.

You may receive proxy solicitation materials from NMV, including an opposition proxy statement and proxy card. Our board of directors recommends that you do not sign or otherwise vote using any proxy card sent to you by NMV. To vote as our board of directors recommends, stockholders must use the WHITE proxy card or attend the annual meeting and vote virtually. Voting against any NMV nominees or voting to withhold or abstain on the proxy card sent to you by NMV will not be counted as a vote for our board's nominees and will result in the revocation of any previous vote you may have cast on the WHITE proxy card. If you wish to vote pursuant to the recommendation of our board of directors, you should disregard any proxy card you receive other than the WHITE proxy card. If you have previously voted using the proxy card sent to you by NMV, you have the right to change your vote by executing a later dated WHITE proxy card or by attending and voting at the annual meeting. Only the latest dated proxy you submit will be counted.

OUR BOARD RECOMMENDS THAT YOU DO NOT VOTE FOR ANY INDIVIDUALS WHO MAY BE NOMINATED BY NMV.

WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED WHITEPROXY CARD AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE, OR PLEASE PROMPTLY SUBMIT YOUR VOTE VIA THE INTERNET OR BY TELEPHONE FOLLOWING THE INSTRUCTIONS ON THEWHITEPROXY CARD, IN ORDER TO ASSURE REPRESENTATION OF YOUR SHARES. NO POSTAGE NEED BE AFFIXED IF THEWHITEPROXY CARD IS MAILED IN THE UNITED STATES.

IN ACCORDANCE WITH OUR SECURITY PROCEDURES, ALL PERSONS ATTENDING THE ANNUAL MEETING WILL BE REQUIRED TO PRESENT GOVERNMENT ISSUED PICTURE IDENTIFICATION.

Our board is soliciting proxies for the annual meeting from our stockholders. We will bear the entire cost of soliciting proxies from our stockholders. Further, we may reimburse brokers, banks and

other nominees that hold shares of our common stock on behalf of beneficial owners for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to such beneficial owners of our common stock. In the event of a contested proxy solicitation for the election of directors, Virtusa may incur additional costs related to the mailing and printing of proxy materials, data processing and tabulation costs, and other related expenses of up to approximately $[ · ] in the aggregate.

We have retained MacKenzie Partners, Inc. ("MacKenzie") to aid in soliciting proxies and advise on certain matters relating to the annual meeting for a fee estimated not to exceed $[ · ] plus reasonable out-of-pocket expenses. MacKenzie has informed us that approximately twenty-five (25) of its employees will assist in the solicitation. Proxies may be solicited on our behalf by telephone or through other means by our directors, officers and other employees who will receive no additional compensation for such services. Appendix B to this proxy statement sets forth information relating to our directors, nominees, executive officers and employees who are considered "participants" in our solicitation under the rules of the Securities and Exchange Commission (the "SEC"). If there is a contested solicitation for the election of directors at the annual meeting, Virtusa will also incur significant additional expenses related to the solicitation (in excess of those normally spent for an annual meeting). To date, as a result of the nomination of candidates by NMV and the potential proxy contest related thereto, the Company has incurred approximately $[ · ] related to the fees of legal, financial and other advisors (including MacKenzie). If the contested solicitation proceeds, we expect to incur an additional $[ · ] of such fees and expenses, resulting in an aggregate amount of approximately $[ · ].

VIRTUSA AT A GLANCE

Virtusa is a leading global provider of digital engineering, consulting, and information technology ("IT") services and solutions that help our clients change, disrupt, and unlock new value. We combine our deep industry and domain expertise with the right tools, techniques, accelerators and agile teams to help businesses move forward, faster.

Our digital engineering services and solutions solve some of the most complex and rapidly evolving problems for global 2000 companies.

Our experience with a large customer base provides us with real-time, granular, and globally differentiated market intelligence to investments in the research, infrastructure, and training.

We are innovation engineers.

Our mission

We apply domain and technology innovation to accelerate business outcomes for our clients.

Our strategy

With over 22,000 world class professionals, servicing clients from 50+ locations in 24 countries, our strategy focuses on three fundamental pillars:

Our values

Agile in thought and transparent in action, our organization is innately driven to find a better way through our PIRL values.

FY2020 performance highlights

Background of the Solicitation

The following timeline is provided to make clear how extensive the discussions have been between the Company and New Mountain Vantage Advisers, L.L.C. ("NMV"), regarding the Company's business and potential candidates to join our Board. We believe this illustrates our openness to input from all shareholders and stakeholders as well as the earnestness of our efforts to seek a resolution without incurring the expenses of a proxy contest. NMV has nominated three directors in opposition to the two (2) class I directors who are recommended by our Board for election. The Board does not endorse the NMV nominees and unanimously recommends you use the WHITE proxy card to vote FOR the election of each of the nominees proposed by the Board. The Board also recommends that you do not sign or return any proxy cards sent to you from NMV.

Following the Company's 2019 annual meeting, the Board had discussions about augmenting the Board with new members and undertook the process of determining the qualifications and skills desired for such new members. As discussed in the section below entitled "How We Are Selected," our Nominating and Corporate Governance Committee (the "Nominating Committee") seeks members from diverse professional backgrounds who combine public company senior executive and board-level experience with a broad spectrum of relevant industry and strategic experience and expertise, that, in concert, offer us and our stockholders diversity of opinion and insight in the areas most important to us and our corporate mission. In addition, nominees for director are selected to have complementary, rather than overlapping, skill sets. Through this skills-based approach, our Nominating Committee focused on reviewing the skill set of our then-existing directors and adding to our Board directors who would bring new perspectives and broaden the experience of the Board. The Nominating Committee actively seeks to identify candidates who would strengthen the ability of

our Board to offer practical business advice and strategic guidance to management and fulfill its fiduciary duties to stockholders.

On March 27, 2020, at NMV's request, a call took place between our Chief Financial Officer, Ranjan Kalia and Tyler Saitta, a NMV Vice President, in which Mr. Saitta asked questions regarding the Company's business and strategy for the future.

On April 23, 2020, at NMV's request, our Chairman and Chief Executive Officer, Kris Canekeratne and Mr. Kalia had a call with Chad Fauser, Head of Engagement for NMV and Prasad Chintamaneni, Managing Director of NMV. These meetings covered a broad range of topics, including the Company's business and results of operations, our earnings performance, long-term business strategies, capital allocation and the composition of our Board.

On April 29, 2020, at NMV's request, Mr. Canekeratne, Mr. Kalia and our Chief Strategy Officer, Thomas Holler, had a call with representatives of NMV, including Mr. Fauser and Mr. Chintamaneni. At this meeting the representatives of NMV delivered a presentation to the Company which included NMV's views regarding the Company's operating margins, M&A strategy and corporate governance. The NMV representatives also made a request for Board representation for Mr. Chintamaneni and Mr. Fauser, both NMV employees.

From May 1 through 12, 2020, the Board held meetings, together with members of management and advisors, to discuss NMV's demands and potential next steps. At the meetings, representatives of the Company's advisors reviewed with the Board the mechanics, expense and timetable related to a potential proxy contest with NMV. The Board also discussed steps that could be taken to avoid the expense and distraction of a potential proxy contest with NMV. Finally, the Board reviewed elements of NMV's business strategy presentation against the Company's current Three Pillar strategy and concluded that the Company's current plan would, if successfully implemented, address the points of concern in NMV's presentation. The Board engaged in a lengthy discussions of these topics during which questions were asked and answered by the advisors.

On May 18, 2020, following the Company's announcement of its fourth quarter and fiscal year 2020 financial results on May 13, 2020, Mr. Canekeratne, Mr. Kalia and Mr. Holler had a discussion with representatives of NMV, including Mr. Fauser and Mr. Chintamaneni. During this discussion, the NMV representatives expressed their views regarding certain issues related to the Company's business, strategies and financial performance. In addition, NMV requested that the Board form a new Business Optimization Committee which would be comprised principally of the proposed NMV representatives. On May 20, 2020, Mr. Fauser contacted Mr. Canekeratne and asked to speak with the Company's directors and Mr. Canekeratne said that he would arrange such a meeting.

On May 27, 2020, our Lead Independent Director and Chair of our Nominating Committee, Rowland Moriarty, and our Series A Director and member of our Nominating Committee, Vikram Pandit, had a discussion with representatives of NMV, including Mr. Fauser and Mr. Chintamaneni. During this discussion, Mr. Moriarty and Mr. Pandit acknowledged NMV's interest in joining the Board and invited Mr. Fauser and Mr. Chintamaneni to participate in the Board's standard process for evaluating director candidates that involves interviews, reference checks and other steps to help ensure both a complementary fit with the Board, as well as finding candidates with skill sets that align with the Company's current business needs.

Later on May 27, 2020, the Board and the Nominating Committee held a meeting, together with members of management and advisors, and discussed NMV's demands, the composition of the Board and various corporate governance matters. At these meetings the directors also discussed

steps that could be taken to avoid the expense and distraction of a potential proxy contest with NMV. The Board also decided to offer NMV an opportunity to provide responses to certain questions that our directors had regarding the perspectives expressed by NMV's representatives.

On May 30, 2020, Mr. Moriarty emailed Mr. Fauser and Mr. Chintamaneni a set of nine questions from the Board for NMV to address. The following day, Mr. Pandit and Mr. Moriarty conducted a call with representatives of NMV to address their questions regarding the purpose of the questionnaire, whether the request represented constructive engagement by the Company that was likely to lead to increased stockholder representation on the Board, and whether other candidates considered for Board appointment are required to complete a similar questionnaire.

During June 2020, the Nominating Committee continued its work to identify potential new director candidates. In this search, the Nominating Committee continued to follow the Company's longstanding approach of reviewing the skill sets of existing directors, identifying future Company needs, and identifying the qualifications and skill sets that new board members would bring to the Board. The Nominating Committee conducted interviews with four director candidates, including Mr. Fauser and Mr. Chintamaneni, and spoke to references for these candidates during this period.

On June 2, 2020, the Board held a meeting, together with members of management and advisors, to review, among other things, the recent discussions with NMV. The Board discussed NMV's demands, the composition of the Board and various corporate governance matters. The Board also discussed steps that could be taken to avoid the expense and distraction of a potential proxy contest with NMV, including considering Mr. Fauser and Mr. Chintamaneni in its process for identifying potential new director candidates. Following discussion, the Board determined to propose that Mr. Fauser and Mr. Chintamaneni be interviewed by directors Deborah Hopkins and Izhar Armony, the two members of the Nominating Committee who had not yet met with Mr. Fauser and Mr. Chintamaneni.

Following the Board meeting, Mr. Canekeratne emailed Mr. Fauser to inform him that members of the Nominating Committee, Ms. Hopkins and Mr. Armony, would arrange interviews with Mr. Fauser and Mr. Chintamaneni and gather more information in accordance with the Board's standard procedure for considering potential new director candidates.

Also on June 2, 2020, Mr. Fauser and Mr. Chintamaneni emailed Mr. Moriarty NMV's responses to the May 30 questions. NMV's responses were provided to the Board.

On June 9, 2020, Ms. Hopkins and Mr. Armony each interviewed both Mr. Fauser and Mr. Chintamaneni.

On June 11, 2020, the Board and the Nominating Committee held meetings, together with members of management and advisors, to consider, among other things, potential new director candidates. The Board and Nominating Committee discussed four director candidates, which included Mr. Fauser and Mr. Chintamaneni. The members of the Nominating Committee provided feedback regarding each of the candidates. The Nominating Committee noted that one of the candidates, Abidali Neemuchwala, had extensive public company senior executive and board-level experience and possessed the skill set sought by the Company. Following discussion, the Board and Nominating Committee determined to further consider the potential new director candidates at subsequent meetings.

On June 12, 2020, Mr. Canekeratne, Mr. Kalia and Mr. Holler had a discussion with representatives of NMV, including Mr. Fauser and Mr. Chintamaneni. Mr. Canekeratne informed the

representatives of NMV that the Nominating Committee was in the process of identifying a potential new director candidate whom it would consider adding to the Board. Mr. Canekeratne also indicated that the Company would be open to having NMV meet with the candidate, and that the Company would be willing to jointly announce with NMV the addition of a highly experienced industry veteran to the Board.

On June 14, 2020, Mr. Moriarty and Mr. Pandit had a discussion with representatives of NMV, including Mr. Fauser. Mr. Fauser reiterated NMV's views regarding certain issues related to the Company's business, strategies, financial performance and corporate governance. Mr. Fauser also expressed his opinion regarding Institutional Shareholder Services Inc.'s ("ISS") ranking of the Company and his understanding that ISS would recommend voting against the Company's director nominees at the 2020 annual meeting. Mr. Moriarty and Mr. Pandit questioned Mr. Fauser's assertions about the position of ISS and noted that the Company had not disclosed its nominees for the current election or even made any final decisions and had not as of yet had any engagement with ISS on the topic. Mr. Fauser rephrased his position and indicated that it was simply his belief that ISS would recommend against the Company's nominees. Mr. Moriarty and Mr. Pandit thanked Mr. Fauser and his colleagues for their time and input and concluded by noting that the Company values input from all of its stockholders.

Also on June 14, 2020, the Board and the Nominating Committee held meetings, together with members of management and advisors, to consider potential new director candidates and the recent discussions with NMV. After due consideration, and in accordance with the Company's corporate governance policies, the Nominating Committee unanimously determined that Mr. Fauser and Mr. Chintamaneni did not have the extensive public company C-suite senior executive or board-level experience and other qualifications which they were seeking in new director candidates. In addition, the Committee noted that Mr. Chintamaneni's executive experience was in the BFSI space which both NMV and the Company had separately concluded was a sector that the Company should seek to expand beyond. As a result, the Committee concluded that it was not in the best interests of the Company and its stockholders to grant NMV's demand for Mr. Fauser and Mr. Chintamaneni to be added to the Board. During these meetings, the Nominating Committee also officially considered the candidacy of Mr. Neemuchwala. The Board and the Nominating Committee noted Mr. Neemuchwala's extensive public company senior executive and board-level experience and determined that he possessed the skill set sought by the Company and would provide valuable insight as the Company continued to focus on creating value for stockholders. The Board and the Nominating Committee determined to pursue Mr. Neemuchwala to join the Board. The Board again discussed steps that could be taken to resolve the issues with NMV, including inviting NMV into the process to vet Mr. Neemuchwala's candidacy and proposing to add an additional independent director candidate mutually acceptable to NMV and the Board. The Committee also noted that it was anticipated that one of our long-standing directors was not going to stand for re-election at the 2020 annual meeting.

On June 15, 2020, Mr. Canekeratne and Mr. Moriarty had a discussion with representatives of NMV, including Mr. Fauser. Mr. Fauser reiterated NMV's demands discussed at the previous meetings. Mr. Canekeratne and Mr. Moriarty informed NMV that the Nominating Committee had identified a potential new director candidate whom it was interested in adding to the Board. Mr. Canekeratne and Mr. Moriarty also indicated the Board's willingness to consider material changes to the composition of the Board. These changes included adding an additional independent director candidate mutually acceptable to NMV and the Board following the Nominating Committee's process, and having one of our long standing directors retire. The NMV representatives were also invited to meet with and provide input on the candidate that the Board felt was most qualified. Mr. Fauser stated that anything short of adding either himself or Mr. Chintamaneni to the Board was

a "non-starter" for NMV. Mr Fauser also indicated NMV's willingness to compromise by modifying its request such that if the Board appointed either of Mr. Fauser or Mr. Chintamaneni, and one director not affiliated with NMV, but who was mutually acceptable to NMV and the Company, NMV would not submit a nomination notice (or would withdraw it, if submitted). Mr. Fauser then indicated that NMV would discuss internally and respond to the Board's proposal.

On June 17, 2020, NMV sent the Company a notice of intent to nominate the following three candidates for election as directors at the Company's 2020 annual meeting: Michael J. Baresich, Ramakrishna Prasad Chintamaneni and Patricia B. Morrison. Also on June 17, 2020, NMV sent a letter to the Board. In particular, NMV's letter discussed its views regarding the Company's (i) operating margins, (ii) EPS growth, (iii) capital allocation, and (iv) corporate governance.

Also on June 17, 2020, Mr. Moriarty and Ms. Hopkins had a discussion with representatives of NMV, including Mr. Fauser. Mr. Fauser expressed his opinion that NMV's candidates, Mr. Baresich, Mr. Chintamaneni and Ms. Morrison, would add value to the Board, and that the Board's appointment of a new independent director at the present time would not be well received by the Company's stockholders notwithstanding how well qualified the person may be.

On June 18, 2020, the Board and the Nominating Committee met, together with members of management and advisors, to consider potential new director candidates and the recent discussions with NMV. Following the recommendation of the Nominating Committee, our Board then officially voted to add Mr. Neemuchwala to the Board. The Nominating Committee determined that that it would continue conducting the process to identify and seat additional new, highly qualified independent directors, and would evaluate NMV's independent director candidates under this process.

On June 19, 2020, the Company issued a press release announcing the appointment of Mr. Neemuchwala to our Board. The Company also announced that the Board intended to continue conducting a vigorous process to identify and seat new, highly qualified independent directors to the Board. The Company also disclosed it had received NMV's nomination of director candidates and stated that the Board welcomed the opportunity to interview NMV's independent director candidates.

On June 22, 2020, NMV issued a press release disclosing its nomination of its three director nominees and its June 17 letter to the Board. NMV also announced that it would be willing to withdraw its nominations in exchange for: (i) adding either Mr. Fauser or Mr. Chintamaneni to the Board; (ii) adding one of NMV's independent nominees to the Board and (iii) the Company's public commitment to a margin improvement and revenue diversification strategy.

On June 23, 2020, Mr. Moriarty emailed Mr. Fauser and indicated that the Nominating Committee wanted to interview NMV's independent director nominees, Mr. Baresich and Ms. Morrison, as the Nominating Committee was seeking to add one more independent director to our Board as discussed in the Company's June 19 press release.

On July 2, 2020, the Board met, together with members of management and advisors, to consider potential new director candidates and the recent discussions with NMV. The Board discussed the feedback and interviews regarding potential new director candidates. The Board also discussed steps that could be taken to avoid the expense and distraction of a potential proxy contest with NMV.

On July 6, 2020, NMV filed a Schedule 13D with the SEC disclosing it beneficially owned approximately 8.98% of the Company's outstanding shares of common stock, plus economic

exposure through derivatives to approximately 1.79% of the Company's outstanding shares of common stock. Also on that day NMV delivered to the Company a demand letter for a copy of a list of the Company's stockholders pursuant to Section 220 of the Delaware General Corporation Law (the "220 Demand Letter").

During late June and July, 2020, the members of the Nominating Committee, as well as our directors, Barry Nearhos and Al-Noor Ramji, and Mr. Canekeratne interviewed Ms. Morrison and Mr. Baresich.

On July 22, 2020, the Company entered into a confidentiality agreement with NMV relating to the 220 Demand Letter.

On July 27, 2020, NMV delivered to the Company a purported demand letter for copies of certain corporate records of the Company related to the Company's margin improvement, revenue diversification, management compensation, director selection and review process, corporate governance, financing committee activities, and acquisition of Polaris Consulting and Services, Ltd., pursuant to Section 220 of the Delaware General Corporate Law. The Company is assessing the demand letter and will respond accordingly. On July 29, 2020, NMV filed an amendment to its Schedule 13D with the SEC attaching the demand letter and disclosing that NMV beneficially owned approximately 9.89% of the Company's outstanding shares of common stock, plus economic exposure through derivatives to approximately 0.90% of the Company's outstanding shares of common stock.

On August 3, 2020 the Company filed with the SEC a preliminary proxy statement with respect to the 2020 annual meeting. In the preliminary proxy statement the Company disclosed that William K. O'Brien, who is currently a Class I director, was not nominated for reelection to the Board because he is over the age of 72, and pursuant to our corporate governance guidelines, unless otherwise approved by the Board, no director who is 72 years of age or older will be nominated for re-election. Mr. O'Brien will remain on the Board until the 2020 annual meeting and the successors to the Class I directors which are up for election at the 2020 annual meeting are duly elected.

At the time of Mr. O'Brien's re-election to the Board at the 2017 annual meeting, the Board had experienced a lot of turn-over of long-tenured directors who stepped off the Board, including Ron Maheu, Martin Trust and Bob Davoli. Given this, the Board determined that it was important to retain Mr. O'Brien on the Board to ensure some level of continuity and also because his financial experience was critical to the Board. At the present time, the Board determined that there was sufficient continuity and also that a number of the other members were positioned to provide the level of financial and business experience necessary for the Board to function effectively.

On August 5, 2020, NMV filed with the SEC a preliminary proxy statement with respect to the 2020 annual meeting.

On August 6, 2020, at the direction of the Board, representatives of the Company's outside counsel had a call with representatives of NMV's outside counsel to discuss whether a consensual resolution might be reached in order to avoid the expense and distraction of a proxy fight.

On August 10, 2020, the Company filed with the SEC an amended preliminary proxy statement with respect to the 2020 annual meeting.

SECURITY OWNERSHIPOUR BOARD OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTDIRECTORS

The following table sets forth certain information regarding beneficial ownership of our common stock at June 30, 2018: (i) by each person who is known by us to beneficially own more than 5% of the outstanding shares of common stock and Series A Preferred Stock; (ii) by each director or nominee; (iii) by each named executive officer; and (iv) by all directors and executive officers as a group. Unless otherwise noted below, the address of each person listed on the table is c/o Virtusa Corporation, 132 Turnpike Road, Southborough, Massachusetts 01772.

Name of Beneficial Owner | Number of Common Shares Beneficially Owned(1) | Percentage of Class Beneficially Owned(2) | Number of Shares of Series A Convertible Preferred Stock Beneficially Owned | Percentage of Class Beneficially Owned(2) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Five percent stockholders: | |||||||||||||

FMR LLC(3) | 3,642,497 | 11.12 | % | — | 0.00 | % | |||||||

245 Summer Street | |||||||||||||

Boston, MA 02210 | |||||||||||||

BlackRock, Inc.(4) | 3,408,244 | 10.41 | % | — | 0.00 | % | |||||||

55 East 52nd Street | |||||||||||||

New York, NY 10022 | |||||||||||||

The Vanguard Group(5) | 2,107,167 | 6.44 | % | — | 0.00 | % | |||||||

100 Vanguard Blvd. | |||||||||||||

Malvern, PA 19355 | |||||||||||||

Dimensional Fund Advisors LP(6) | 2,028,563 | 6.20 | % | — | 0.00 | % | |||||||

Building One | |||||||||||||

6300 Bee Cave Road | |||||||||||||

Austin, TX 78746 | |||||||||||||

Orogen Viper LLC(7) | 3,000,000 | 9.16 | % | 108,000 | 100 | % | |||||||

One Rockefeller Plaza | |||||||||||||

Suite 2416 | |||||||||||||

New York, NY 10020 | |||||||||||||

Executive officers, directors and director nominees: | |||||||||||||

Kris A. Canekeratne(8) | 753,020 | 2.30 | % | — | * | ||||||||

Ranjan Kalia(9) | 82,196 | * | — | * | |||||||||

Raj Rajgopal(10) | 29,875 | * | — | * | |||||||||

Samir Dhir(11) | 59,159 | * | — | * | |||||||||

Thomas R. Holler(12) | 14,382 | * | — | * | |||||||||

Izhar Armony(13) | 26,855 | * | — | * | |||||||||

Rowland T. Moriarty(14) | 449,514 | 1.37 | % | — | * | ||||||||

William K. O'Brien(15) | 35,077 | * | — | * | |||||||||

Al-Noor Ramji(16) | 28,509 | * | — | * | |||||||||

Barry R. Nearhos(17) | 4,115 | * | — | * | |||||||||

Joseph G. Doody(18) | 1,373 | * | — | * | |||||||||

Vikram S. Pandit(19) | 908 | * | — | * | |||||||||

Deborah C. Hopkins(20) | — | * | — | * | |||||||||

All executive officers, directors and nominees as a group (15 persons)(21) | 1,680,187 | 5.11 | % | ||||||||||

stock, issuable upon conversion of 108,000 shares of Series A Preferred Stock. Orogen Viper LLC has shared voting power and shared dispositive power with respect to 3,000,000 of the shares of common stock beneficially owned with Orogen Holdings LLC, Vikram S. Pandit, Atairos-Orogen Holdings, LLC, Atairos Group, Inc., Atairos Partners, L.P., Atairos Partners GP, Inc., and Michael J. Angelakis. Mr. Vikram S. Pandit is Chairman and CEO of Orogen Viper LLC.

and which will not settle within 60 days of June 30, 2018. The grantee retains no voting rights in restricted stock units until vesting but does retain voting rights with respect to shares of unvested restricted stock awards unless and to the extent that such shares are forfeited.

PROPOSAL 11—

ELECTION OF DIRECTORS

Our board of directors currently consists of eightten members. Pursuant to our bylaws, our board of directors, on June 18, 2018, fixed the size of the Board at nine (9) members, subject to and effective upon the election of Ms. Deborah (Debby) C. Hopkins at our 2018 annual meeting of stockholders on September 6, 2018.

Our seventh amended and restated certificate of incorporation also divides the members of our board of directors that are elected by all holders of our capital stock into three classes. One class is elected each year for a term of three years. TheseWe are asking our stockholders to elect two (2) class I directors, as nominated by our board of directors, for a three-year term, and, with respect to the holders of our Series A Convertible Preferred Stock, one (1) Series A director, until his/her successor is duly elected and qualified or until such Series A director's right to hold the office terminates, whichever occurs earlier. The following table sets forth the nominees to be elected at the annual meeting and continuing directors.

| Nominee's or Director's Name | Age | Director Since | Position(s) with the Company | Independent | Other Public Company Boards | Year Current Term Will Expire | Current Class of Director | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Nominees for Class I Director | ||||||||||||||||||

Al-Noor Ramji | | 66 | | 2011 | Director | Yes | | — | | 2020 | I | |||||||

Joseph G. Doody | 67 | 2017 | Director | Yes | 2 | 2020 | I | |||||||||||

Nominee for Series A Director |

|

|

| |||||||||||||||

Vikram S. Pandit | | 63 | | 2017 | Series A Director | Yes | | 2 | | — | Series A Director (1) | |||||||

Continuing Directors |

|

|

| |||||||||||||||

Izhar Armony | | 56 | | 2004 | Director | Yes | | — | | 2021 | II | |||||||

Rowland T. Moriarty | 73 | 2006 | Director | Yes | 2 | 2021 | II | |||||||||||

Deborah C. Hopkins | | 65 | | 2018 | Director | Yes | | 2 | | 2021 | II | |||||||

Kris Canekeratne | 54 | 1996 | Chief Executive Officer and Chairman of the Board | No | — | 2022 | III | |||||||||||

Barry R. Nearhos | | 62 | | 2016 | Director | Yes | | 1 | | 2022 | III | |||||||

Abidali Neemuchwala | 52 | 2020 | Director | Yes | — | 2022 | III | |||||||||||

In accordance with our corporate governance guidelines, William K. O'Brien, who is currently a Class I director, was not nominated for reelection to the board of directors because he is over the age of 72. Mr. O'Brien will remain on the Board until the 2020 annual meeting and the successors to the Class I directors which are up for election at the 2020 annual meeting are duly elected. The Board has resolved to decrease its size to nine members effective upon expiration of the current term of the Class I directors. If all of the Board's nominees are elected, by a majoritythe Board will be comprised of votes cast by stockholders.nine members immediately following the 2020 annual meeting.

The board of directors, upon the recommendation of the nominating and corporate governance committee, has nominated Izhar Armony, Rowland T. MoriartyAl-Noor Ramji and Deborah C. Hopkins,Joseph G. Doody and recommended that each

nominee be elected to the board of directors as a class IIClass I director, each to hold office until the annual meeting of stockholders to be held in the year 20212023 and until his/her successor has been duly elected and qualified or until his/her earlier death, resignation or removal.

The board of directors is also composed of (i) two (2) class III directors (Kris Canekeratne and Barry R. Nearhos) whose terms expire upon the election and qualification of directors at the annual meeting of stockholders to be held in 2019 and (ii) three (3) class I directors (William K. O'Brien, Al-Noor Ramji, and Joseph G. Doody) whose terms expire upon the election and qualification of directors at the annual meeting of stockholders to be held in 2020. In addition, under the terms of our Series A Convertible Preferred Stock issued to Orogen Viper LLC ("Orogen") in connection with their purchase of an aggregate of 108,000 shares of convertible preferred stock Also, for aggregate consideration of $108 million which closed on May 3, 2017, and the terms of the Investment Agreement dated as of May 3, 2017 by and between the Company and Orogen, the holders of Series A Convertible Preferred Stock, voting separately as a class and to the exclusion of holders of all other classes of our capital stock, have the right to elect one (1) Series A Director (the "Series A Director") to our board of directors, separate and apart from the members of our board of directors that are elected by all holders of our capital stock. For this annual meeting, the board of directors, upon the recommendation of the nominating and corporate governance committee, has nominated Vikram S. Pandit and recommended that such nominee be elected to the board of directors as a Series A Director, to hold office until his successor is duly elected and qualified or until such Series A Director's right to hold the office terminates, whichever occurs earlier, subject to such Series A Director's earlier death, disqualification or removal. Only the holders of our Series A Convertible Preferred Stock have the right to vote on Mr. Pandit's election. Mr. Canekeratne is our chief executive officer and the chairman of the board.

The board of directors knows of no reason why any of the nominees would be unable or unwilling to serve, but if any nominee should for any reason be unable or unwilling to serve, the proxies will be voted for the election of such other person for the office of director as the board of directors may recommend in the place of such nominee. Unless otherwise instructed, the proxy holders will vote the proxies received by them FOR the nominees named below.

For Proposal 1,Each proxy executed and returned by a holder of shares of common stock will be voted for the election of three (3) class II directors, the two Class I director nominees, shall be elected if the number of votes cast forunless otherwise indicated on such nominee's election exceed the number of votes cast against such nominee's electionproxy. Each proxy executed and the one (1) Series A director is electedreturned by a majorityholder of the votes properly cast by the holdersshares of the Series A Convertible Preferred Stock will be voted for the election of the two Class I director nominees and the Series A director nominee, unless otherwise indicated on such proxy.

We have received a notice from NMV for the nomination of three individuals for election to our board of directors at the annual meeting.meeting in opposition to the director nominees named in this proxy statement.

By-law Amendment Adopting Majority Voting The board of directors does not endorse any NMV nominees and unanimously recommends that you vote for the directors who have been named in Uncontested Director Electionsthis proxy statement and on the WHITE proxy card, and do not sign or otherwise vote using any proxy card sent to you by NMV. OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU DO NOT SIGN ANY PROXY CARDS SENT TO YOU BY NMV. IF YOU HAVE PREVIOUSLY SIGNED OR OTHERWISE VOTED USING A PROXY CARD SENT TO YOU BY NMV, YOU CAN REVOKE IT BY SIGNING, DATING AND MAILING THE ENCLOSED WHITE PROXY CARD IN THE ENVELOPE PROVIDED

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

THAT YOU VOTE "FOR" THE NOMINEES LISTED ABOVE FOR

WHICH YOU ARE ENTITLED TO VOTE FOR ELECTION AS A DIRECTOR.

On July 27,We, the members of Virtusa's board of directors, know that the most important decision you, as stockholders, make is that of selecting the people who oversee the Company on your behalf. We, therefore, open this proxy statement by sharing information essential to making these critical voting decisions. In addition to the material in our board profiles that follow, we would like to emphasize some key facts that we think set our board apart.

Our board includes directors who:

Our strength comes from our collective and diverse skills, experiences, and backgrounds, as described in these individual profiles below.

| | | |

Chairman of the board and Chief Executive Officer of the Company Age: 54 Class III Director | | Experience • Co-Founder, Virtusa, Chairman (1996 – present), Chief Executive Officer (1996 – 1997; 2000 – present) • Co-founded eDocs, Inc., a provider of electronic account management and customer care, later acquired by Oracle Corporation (1997) • One of the founding team members of INSCI Corporation, a supplier of digital document repositories and integrated output management products and services (1989 – 1996); Senior Vice President (1992 – 1996) Qualifications • Innovative and passionate entrepreneur co-founded three technology companies and led them to commercial success • Deep knowledge of our Company, our employees, our client base, our prospects, the global IT industry and our competitors • Unique capacity to see the emerging trends and next generation technologies that will significantly impact the course of industries and business in general Education • B.S. in Computer Science, Syracuse University |

| | | |

Managing General Partner at Charles River Ventures Independent Director since 2004 Age: 56 Class II Director Committees: • Nominating and Corporate Governance • Finance (April 1 through November 26, 2019)* Attendance: 94% * Dissolved in favor of an ad hoc M&A committee which may review strategic M&A opportunities from time to time | | Experience • Managing General Partner, Charles River Ventures, a venture capital investment firm (1997 – present) • Served as vice president of marketing and business development, Onyx Interactive, an interactive training company based in Tel Aviv Qualifications • Extensive experience in the technology industry, through both company operations and venture capital investment Education • M.B.A., Wharton School of Business • M.A. in International Studies from the University of Pennsylvania Also... • Served as an officer in the Israeli Army |

| | | |

President and Chief Executive Officer of Cubex Corporation Lead Independent Director Independent Director since 2006 Age: 73 Class II Director Committees: • Nominating and Corporate Governance (Chair) Attendance: 100% | | Experience • President and Chief Executive Officer, Cubex Corporation, a privately-held consulting company (1981 – present) • Professor of Business Administration, Harvard Business School (1981 – 1992) Qualifications • Thorough understanding of our business • Extensive experience regarding the operation and management of complex global organizations Other Public Boards • CRA International, a worldwide economic and business consulting firm (Chair) • WEX Inc. (formerly Wright Express Corporation) Education • D.B.A., Harvard University • M.B.A., Wharton School of Business • B.A., Rutgers University |

| | | |

Independent Director since 2008 Age: 75 Class I Director Not standing for re-election Committees: • Audit • Compensation Attendance: 92% Financial Expert | | Experience • Executive Chairman, Enterasys Networks, a public technology company (2003 – 2006), Chief Executive Officer (April 2002 – March 2004), Member of the board of directors (2002 – 2006) • Worked for over 33 years at PricewaterhouseCoopers ("PwC"), where he served in a number of roles including Chief Operating Officer of the former Coopers & Lybrand, with responsibility for the audit, tax, and financial advisory components of the U.S. business; Managing Partner for the Boston office; and a Global Managing Partner of PwC Qualifications • Extensive financial and accounting expertise • Strong leadership and management background Other Public Boards • Mercury Systems, Inc., a leading commercial provider of secure processing subsystems for a wide variety of critical defense and intelligence programs Education • Graduate, Bentley University |

| | | |

Group Chief Digital Officer of Prudential plc Independent Director since 2011 Age: 66 Class I Director Committees: • Compensation Attendance: 89% | | Experience • Group Chief Digital Officer, Prudential plc (2016 – present) • Chief Strategy Officer, Calypso Technology, Inc., a global application software provider that sells an integrated suite of trading and risk applications to the capital markets function within banks and other financial institutions (2014 – 2016) • Executive Vice President and General Manager, Misys Banking, Misys plc, a mid-size software company that serves the financial services industry (2010 – 2013) • Served in various executive roles at British Telecom, most recently as Chief Executive Officer for BT Innovate and Design, and Chief Information Officer and Chief Technology Officer of BT Group plc. (2004 – 2010) • Executive Vice President, Chief Information Officer and Chief E-Commerce Officer, Qwest Communications • Served as Chief Information Officer at UBS (then called SBC) • Global Head of Operations at Credit Suisse First Boston Qualifications • Extensive industry, domain and operational experience arising from holding management positions in large, complex technology companies, which enables him to provide invaluable insights to the challenges facing IT application outsourcing companies with respect to both the markets and clients being served. Education • Chartered Financial Analyst • BSc in Electronics, University of London Also... • He is a multi-year winner of the CIO 100 Award, CIO Insight IT Leader of the Year 2009, and the British Computer Society CIO of the Year |

| | | |

Independent Director since 2016 Age: 62 Class III Director Committees: • Audit (Chair) • Finance (April 1 through November 26, 2019)* Attendance: 100% Financial Expert * Dissolved in favor of an ad hoc M&A committee which may review strategic M&A opportunities from time to time | | Experience • Over 35 years of experience with PwC providing assurance, business advisory and other services to clients across multiple industries, including technology, life sciences, telecom, and manufacturing, including serving as Market Managing Partner for PwC's Northeast region, responsible for directing the strategy and operations of the firm's Boston, Hartford and Albany offices (2008 – 2015), leader of PwC's Northeast Assurance practice (2005 – 2008), an audit partner in PwC's Assurance practice (1989 – 2015) Qualifications • Extensive financial and accounting expertise as well as extensive knowledge of technology companies • Extensive operational skills and human capital management resulting from his valuable experience of overseeing and managing a workforce of 3,000 employees Other Public Boards • Mercury Systems, Inc., a leading commercial provider of secure processing subsystems for a wide variety of critical defense and intelligence programs Education • Graduate, Boston College |

| | | |

Independent Director since 2017 Age: 67 Class I Director Committees: • Audit • Compensation Attendance: 100% | Experience • Most recently served as Vice Chairman of Staples, Inc. where he led Staples' strategic reinvention and had responsibility for strategic planning, business development, and the company's operations in Australia, New Zealand and high-growth markets, including China and Brazil; previously served as President of North American Commercial, President of North American Delivery and President of North America (1998 – 2017) • Served as President of Danka Office Imaging in North America • Held various managerial positions with Eastman Kodak Company Qualifications • Extensive business experience regarding the planning, business development and strategic management of complex, global organizations Other Public Boards • Casella Waste Systems, Inc., an integrated regional solid waste services company • Paychex, Inc., a leading provider of solutions for payroll, HR, retirement, and insurance services Education • M.B.A., Simon School of Business, University of Rochester • B.S. in Economics from State University of New York at Brockport |

| | | |

Chairman and Chief Executive Officer of The Orogen Group Series A Director since 2017 Age: 63 Committees: • Compensation (effective February 1, 2020) (Chair) • Nominating and Corporate Governance • Finance (April 1 through November 26, 2019)* (Chair) Attendance: 88% * Dissolved in favor of an ad hoc M&A committee which would review strategic M&A opportunities from time to time | Experience • Chairman and Chief Executive Officer, The Orogen Group LLC ("The Orogen Group"), an operating company he created with the Atairos Group, Inc. that makes control and other strategic investments in financial services companies and related businesses (2016 – present). • Chief Executive Officer and Director, Citigroup Inc.; previously led Citi's Institutional Clients Group and Chairman and CEO of Citi Alternative Investments (2007 – 2012) • Founding Member and Chairman, Old Lane LLC, a hedge fund, which was acquired by Citigroup in 2007 • Chief Operating Officer of Institutional Securities and Investment Banking businesses, Morgan Stanley (2000 – 2005); President of Institutional Securities (2003 – 2005); Co-President (2000 - 2003), joined in 1983 Qualifications • Extensive experience and knowledge in banking and financial services • Proven track record of leadership of complex, global financial organizations • Extensive client network individually and as part of The Orogen Group Other Public Boards • ExlService Holdings, Inc. • Bombardier Inc. • The Nasdaq OMX Group, Inc. (formerly) Education • Ph.D. in Finance, Columbia University • M.S. and B.S. in Electrical Engineering, Columbia University | |

Also... • Serves as a Member of Advisory Board of NerdWallet, Inc., the Board of Overseers of Columbia Business School and of the Board of Visitors of the Columbia School of Engineering and Applied Sciences. |

| | | |

Independent Director since 2018 Age: 65 Class II Director Committees: • Nominating and Corporate Governance (effective November 26, 2019) • Finance (April 1 through November 26, 2019)* Attendance: 87% * Dissolved in favor of an ad hoc M&A committee which may review strategic M&A opportunities from time to time | Experience • Founder and Chief Executive Officer, Citi Ventures and Citi's first Chief Innovation Officer (2008 – 2016); joined Citi in 2003 as Head of Corporate Strategy and M&A, and was later appointed to Chief Operations and Technology Officer • Chief Financial Officer, The Boeing Company and Lucent Technologies, • General Auditor, General Motors before being named Vice President of Finance at General Motors Europe • Corporate Controller, Unisys • Started her career at Ford Qualifications • Significant leadership experience in finance, technology and innovation at various multinational companies Other Public Boards • Union Pacific, • Marsh and McLennan Companies • E.I. DuPont de Nemours & Company, Dendrite International and Qlik Technologies (formerly) Education • Honorary doctorates, Westminster College and Walsh College • B.A. in Accounting, Walsh College Also... | |

• Member of the Board of Directors of privately held cybersecurity company, Deep Instinct • Board of Trustees, St. John's Health located in Jackson, Wyoming |

| | | |

Independent Director since 2020 Age: 52 Class III Director Committees: • Audit (effective August 3, 2020) | Experience • Chief Executive Officer and Managing Director, Wipro, a global company delivering innovation-led strategy, technology, and business process services; (2019 – 2020); CEO and Executive Director (2016 – 2019); Group President and Chief Operating Officer (2015 – 2016) • Headed the BPO division of Tata Consultancy Services Limited, a global leader in IT services, consulting & business solutions (2009 – 2015) Qualifications • Extensive leadership, strategic and business experience in the IT services industry Education • India Institute of Technology, Bombay and National Institute of Technology, Raipur. B.E. Electronics and Communications Also... • Serves on the Board of Directors of Texas Economic Development Corporation, an independently funded and operated 501(c)(3) nonprofit organization responsible for marketing and promoting Texas as a premier business location and World Affairs Council of Dallas Fort Worth, a multifaceted informational organization that educate and engage the local community in national and international affairs. • Former member of the Business Roundtable in Washington, DC, IT Governance Council of World Economic Forum (WEG) Davos, US-India Business Council (USIBC). • Former board member of TCS eServe Limited (Indian – BPO) and TCS eServe America Inc (US – Mortgage processing) and Diligent Ltd (UK – Insurance/Life and Pensions Platform) • BPO CEO of the Year 2010 & 2012 |

Excluding Mr. O'Brien who was not nominated for reelection to the board of directors in accordance with our corporate governance guidelines because he is over the age of 72, our board of directors currently consists of nine members and:

The board of directors brings together a diversity of experience. This includes planning, business development and strategic management of complex, global organizations, knowledge of and significant leadership positions in the technology and application outsourcing industry, financial and accounting expertise, and domain experience.

A total of five directors have joined since 2016, enhancing the board's breadth and depth of experience and diversity. Abidali Neemuchwala joined the board in June 2020. Mr. Neemuchwala was identified within our corporate network and recommended to the Nominating and Corporate Governance Committee for consideration. Our nominating and corporate governance committee conducted a rigorous interview and selection process which included a number of potential director candidates before recommending Mr. Neemuchwala.

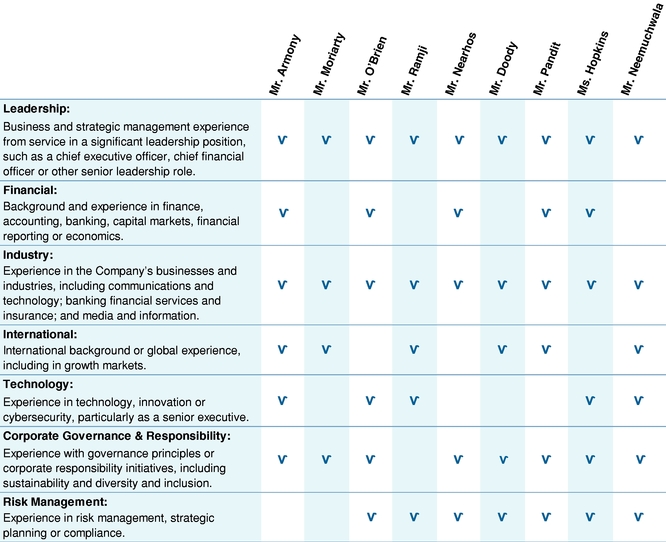

Director Key Skills and Experience